Accounting for

Strategic Growth

Clear numbers. Better decisions.

about us

Sustained Profits is a trusted provider of bookkeeping, tax preparation, and financial advisory services. Our mission is to empower businesses with accurate financial insights, ensuring compliance and fostering growth.

Our Services

Bookkeeping

Day to day financial reporting that keeps your books accurate, organized, and up to date.

Fractional Controller

Accrual accounting, revenue recognition, consolidated and multicurrency reporting, budget vs actuals, and financial coaching.

Oversight services

Review and guidance for in house bookkeeping teams, with a focus on accuracy and efficient workflows.

Tax Preparation and filings

Year round preparation and coordination with your CPA or one of our trusted CPA partners.

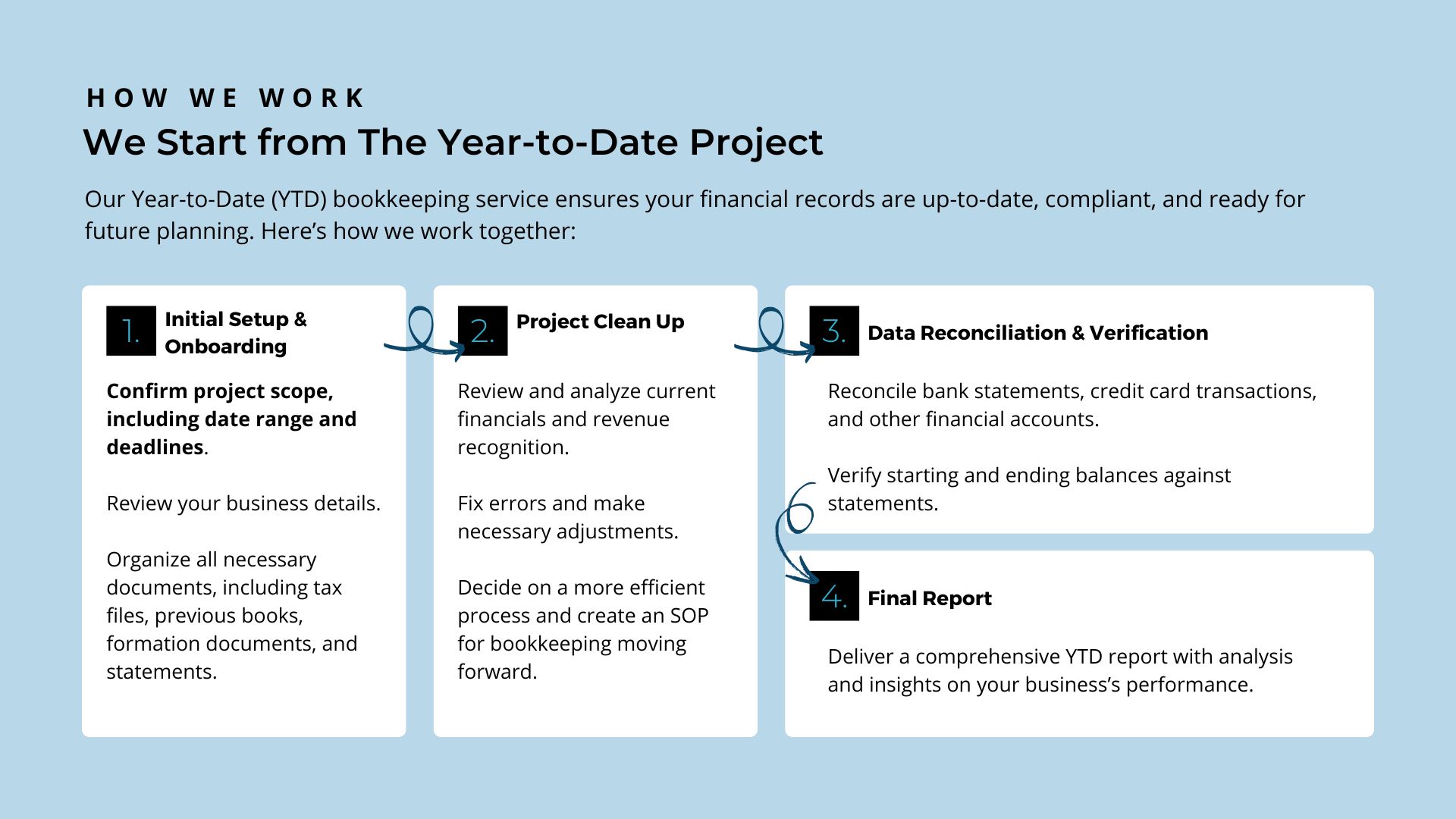

HOW WE WORK

We Start from The Year-to-Date Project

Our Year-to-Date (YTD) bookkeeping service ensures your financial records are up-to-date, compliant, and ready for future planning. Here’s how we work together:

1. Initial Setup & Onboarding

Confirm project scope, including date range and deadlines.

Review your business details.

Organize all necessary documents, including tax files, previous books, formation documents, and statements.

2. Project Clean Up

Review and analyze current financials and revenue recognition.

Fix errors and make necessary adjustments.

Decide on a more efficient process and create an SOP for bookkeeping moving forward.

3. Data Reconciliation & Verification

Reconcile bank statements, credit card transactions, and other financial accounts.

Verify starting and ending balances against statements.

4. Final Report

Deliver a comprehensive YTD report with analysis and insights on your business’s performance.

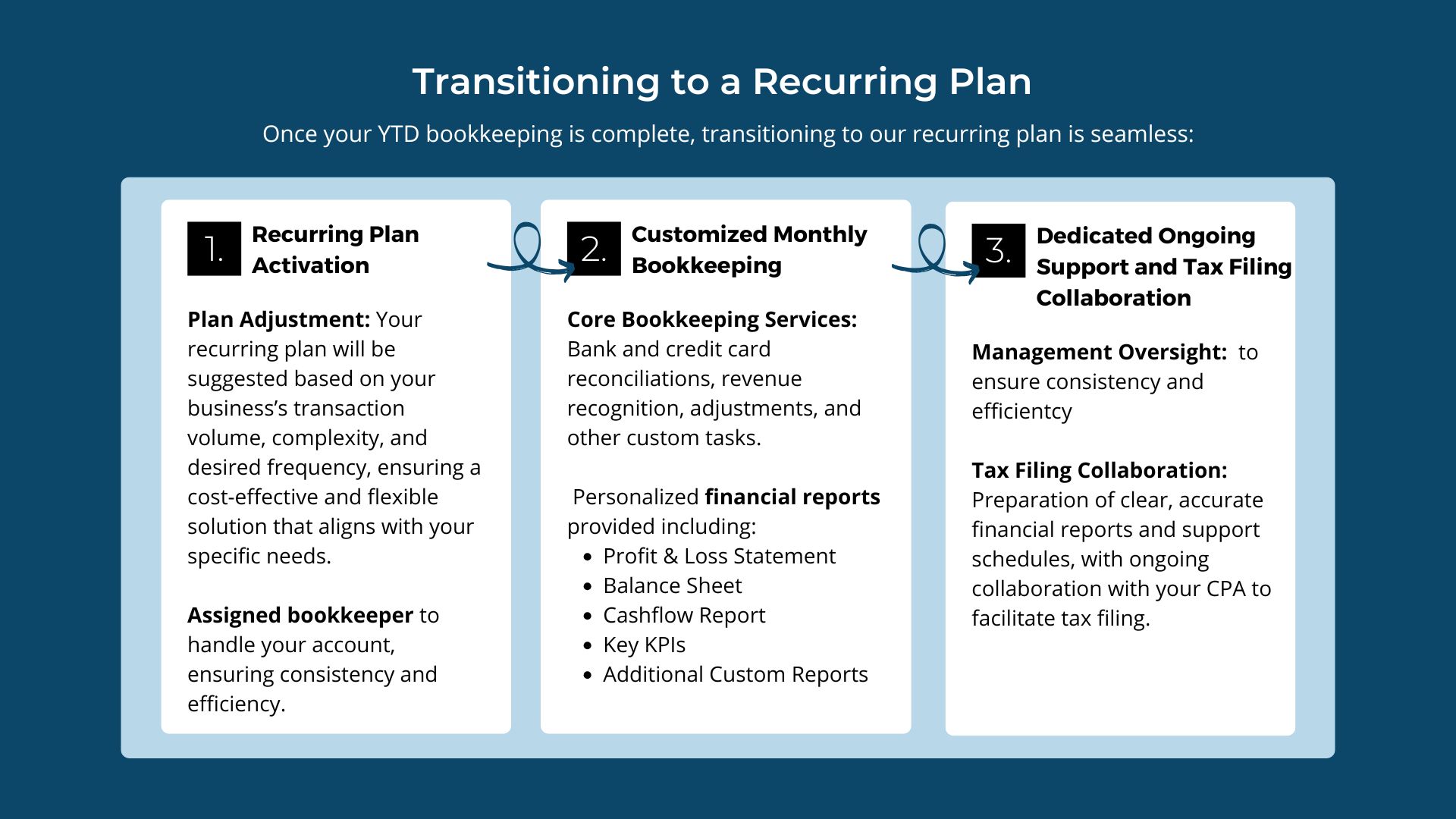

Transitioning to a Recurring Plan

Once your YTD bookkeeping is complete, transitioning to our recurring plan is seamless:

1. Recurring Plan Activation

Plan Adjustment: Your recurring plan will be suggested based on your business’s transaction volume, complexity, and desired frequency, ensuring a cost-effective and flexible solution that aligns with your specific needs.

Assigned bookkeeper to handle your account, ensuring consistency and efficiency.

2. Customized Monthly Bookkeeping

Core Bookkeeping Services:

Bank and credit card reconciliations, revenue recognition, adjustments, and other custom tasks.

Personalized financial reports provided including:

- Profit & Loss Statement

- Balance Sheet

- Cashflow Report

- Key KPIs

- Additional Custom Reports

3. Dedicated Ongoing Support and Tax Filing Collaboration

Management Oversight: to ensure consistency and efficiency

Tax Filing Collaboration: Preparation of clear, accurate financial reports and support schedules, with ongoing collaboration with your CPA to facilitate tax filing.